Global tax withholdings

Global coverage for token tax withholding, EOR, and HR system integration

Global coverage for token tax withholding, EOR, and HR system integration

Manage token-based compensation and tax compliance seamlessly across borders. Our platform integrates with employer-of-record (EOR) services and HR systems to streamline payroll, tax withholding, and reporting for distributed teams worldwide.

Manage token-based compensation and tax compliance seamlessly across borders. Our platform integrates with employer-of-record (EOR) services and HR systems to streamline payroll, tax withholding, and reporting for distributed teams worldwide.

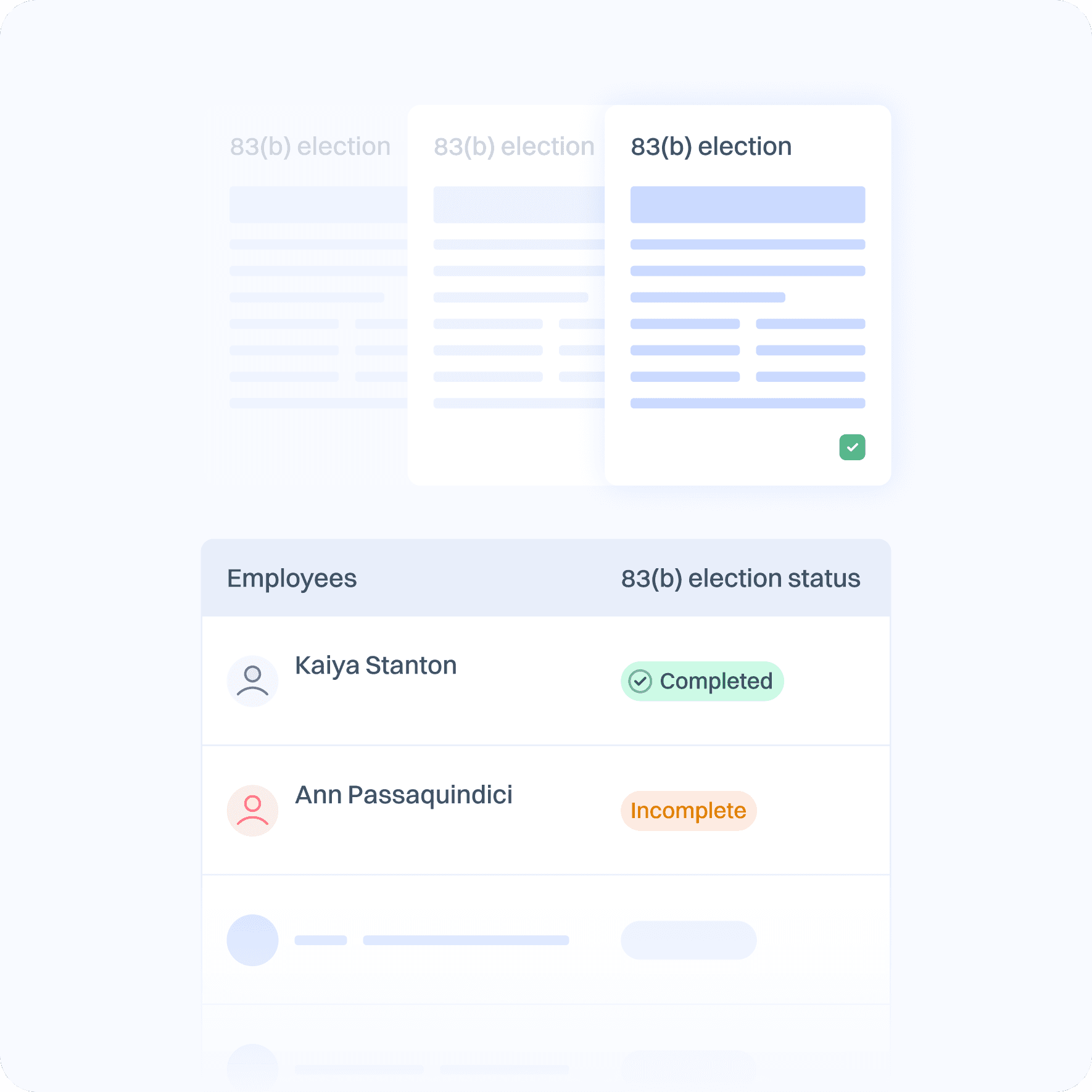

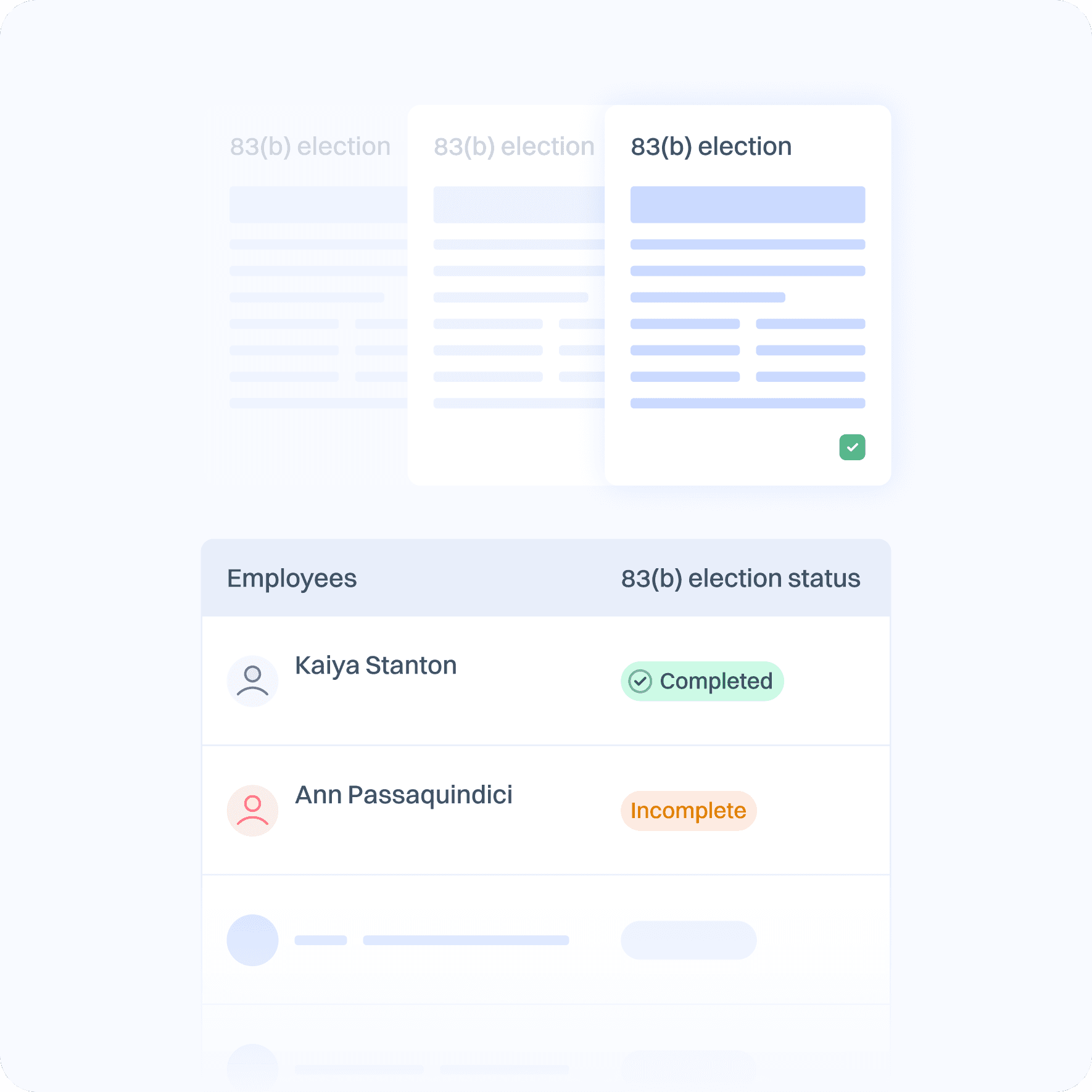

Token taxation and compliance tailored for every country and legal agreement

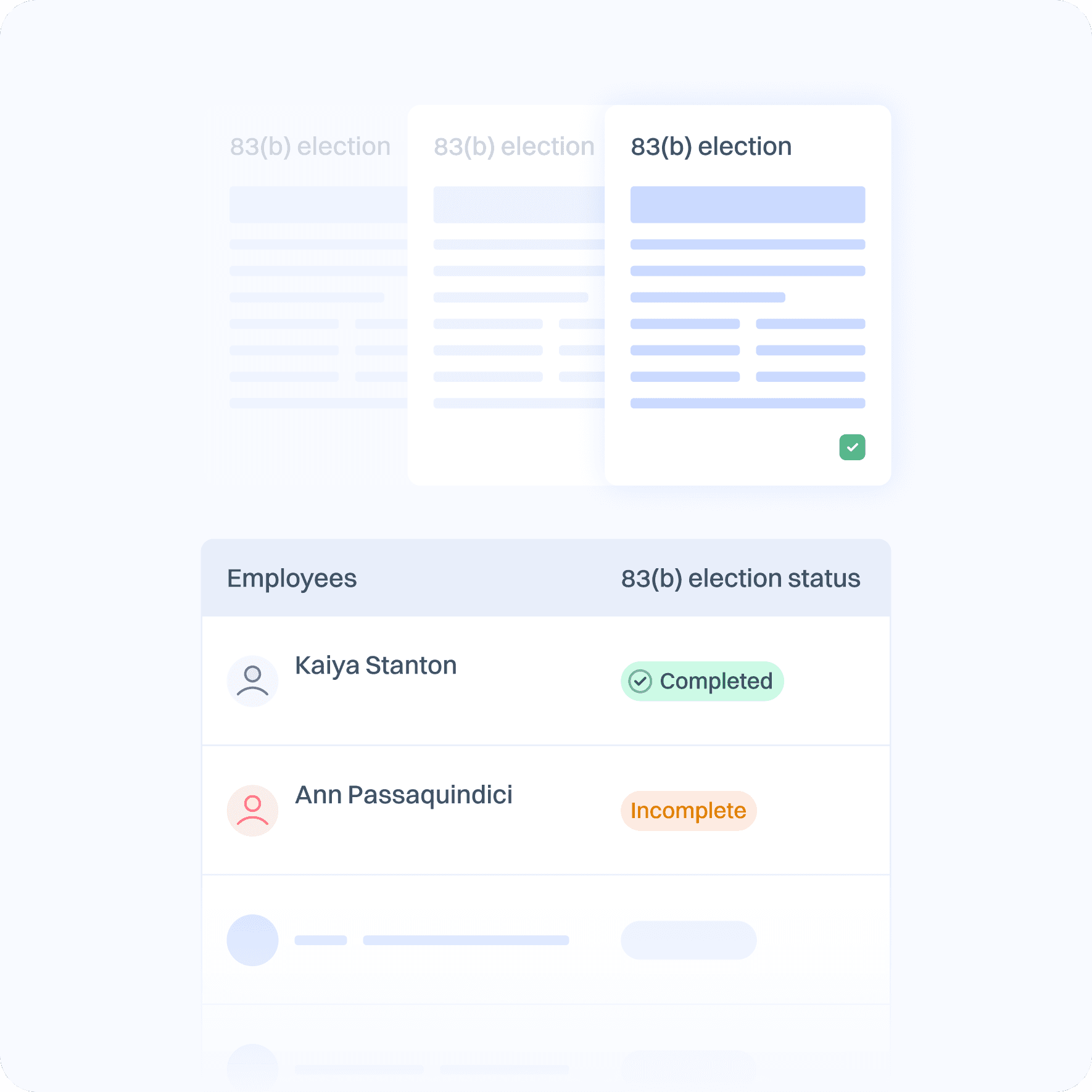

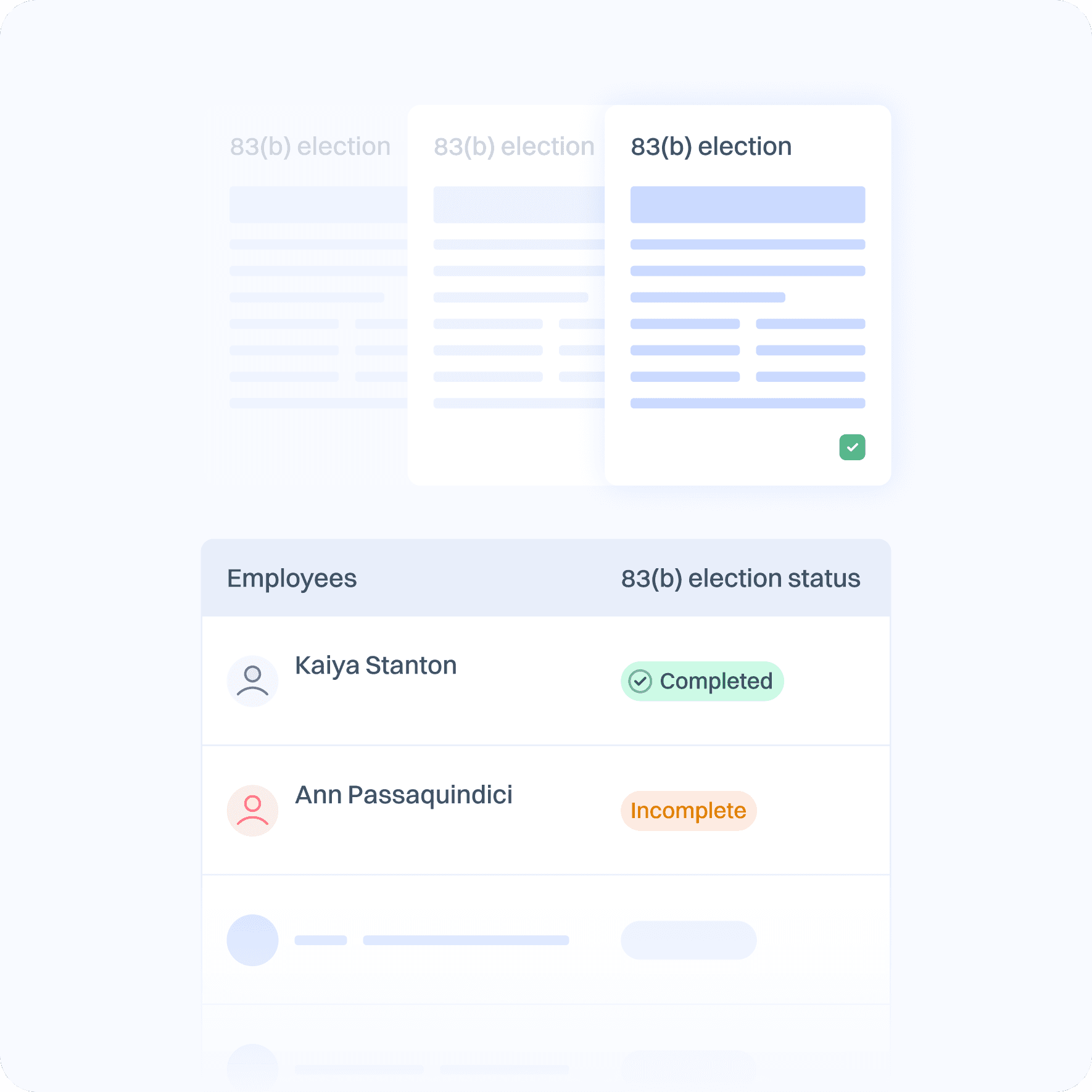

Stay ahead of global tax regulations with tools designed to handle RTUs, RTAs, RTAs with 83(b) elections, and more. We ensure accurate token withholding taxes and keep you compliant with each country’s specific rules, while optimizing your treasury for taxable events and bills

Global compliance

Stay up to date with token tax regulations in every jurisdiction

Automated sell-to-cover

Optimize your treasury by automating sell-to-cover strategies for taxable events and bills

Legal agreement support

Manage RTUs, RTAs, and 83(b) elections with ease

Token taxation and compliance tailored for every country and legal agreement

Stay ahead of global tax regulations with tools designed to handle RTUs, RTAs, RTAs with 83(b) elections, and more. We ensure accurate token withholding taxes and keep you compliant with each country’s specific rules, while optimizing your treasury for taxable events and bills

Global compliance

Stay up to date with token tax regulations in every jurisdiction

Automated sell-to-cover

Optimize your treasury by automating sell-to-cover strategies for taxable events and bills

Legal agreement support

Manage RTUs, RTAs, and 83(b) elections with ease

Token taxation and compliance tailored for every country and legal agreement

Stay ahead of global tax regulations with tools designed to handle RTUs, RTAs, RTAs with 83(b) elections, and more. We ensure accurate token withholding taxes and keep you compliant with each country’s specific rules, while optimizing your treasury for taxable events and bills

Global compliance

Stay up to date with token tax regulations in every jurisdiction

Automated sell-to-cover

Optimize your treasury by automating sell-to-cover strategies for taxable events and bills

Legal agreement support

Manage RTUs, RTAs, and 83(b) elections with ease

Token taxation and compliance tailored for every country and legal agreement

Stay ahead of global tax regulations with tools designed to handle RTUs, RTAs, RTAs with 83(b) elections, and more. We ensure accurate token withholding taxes and keep you compliant with each country’s specific rules, while optimizing your treasury for taxable events and bills

Global compliance

Stay up to date with token tax regulations in every jurisdiction

Automated sell-to-cover

Optimize your treasury by automating sell-to-cover strategies for taxable events and bills

Legal agreement support

Manage RTUs, RTAs, and 83(b) elections with ease

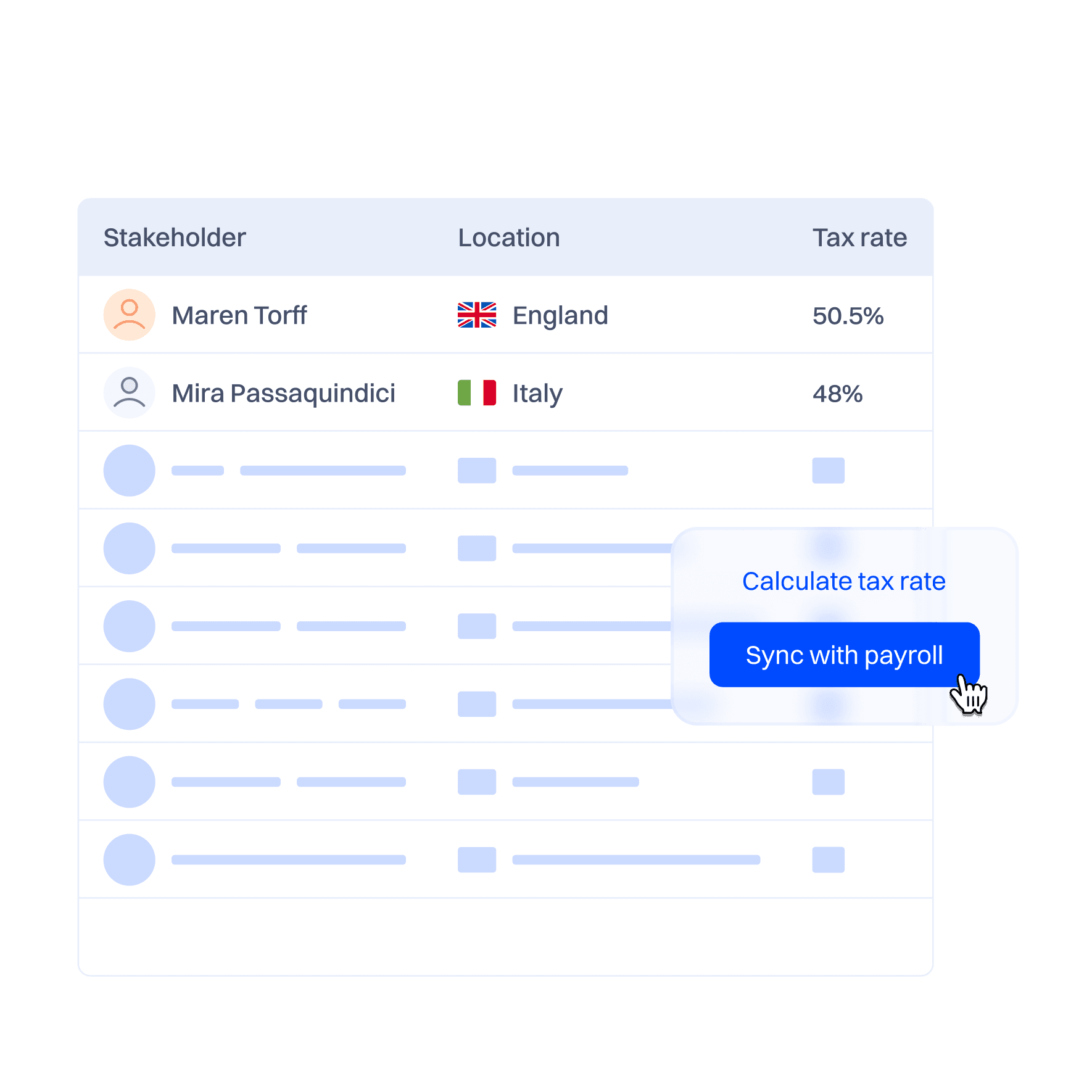

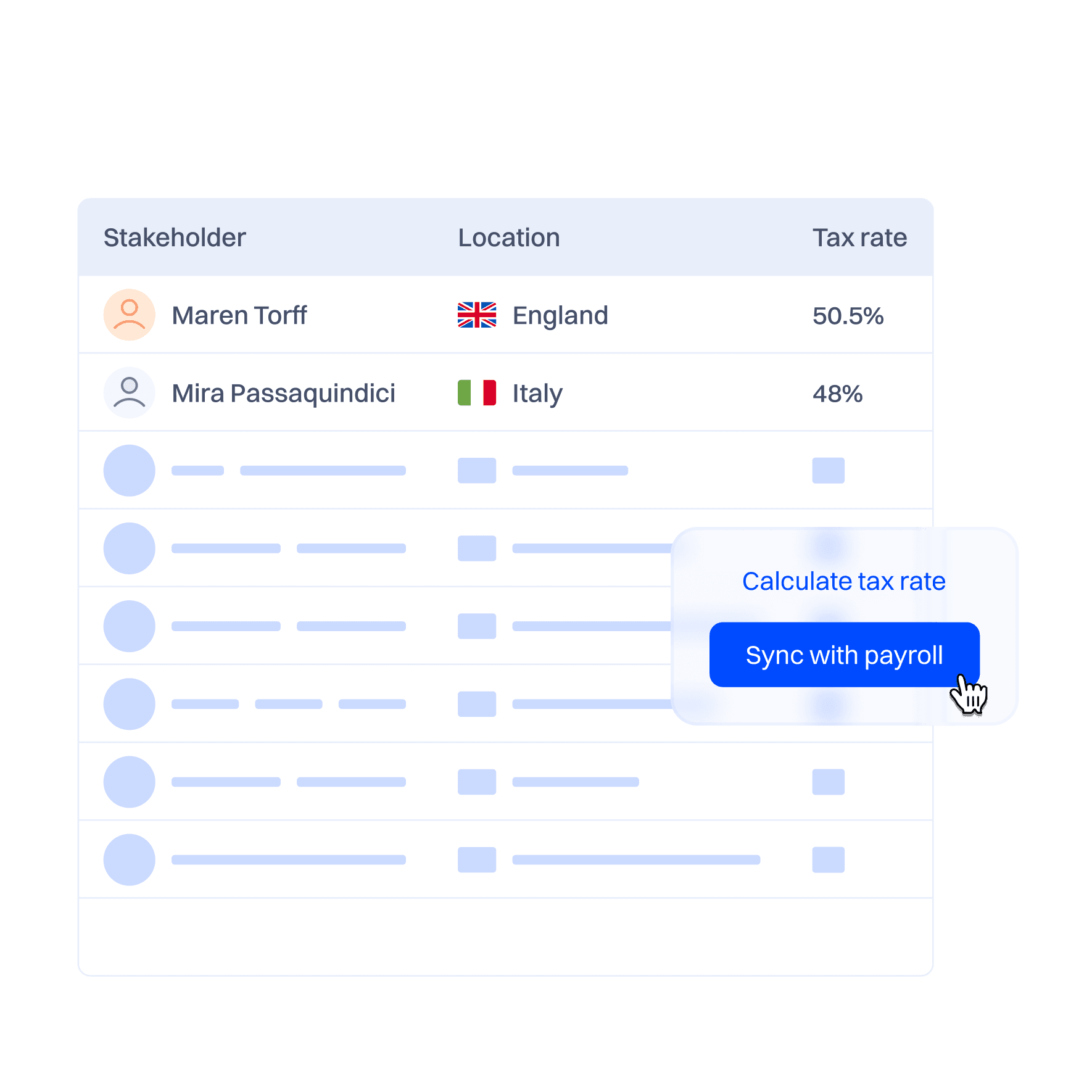

Sync data from your HR System for timely and accurate tax withholdings

Eliminate costly errors by seamlessly integrating and syncing with your payroll systems. Our platform supports leading HR tools like Remote, Justworks, Gusto, and more, ensuring real-time accuracy for tax withholdings and reporting.

Seamless integrations

Connect with Remote, Justworks, Gusto, and other HR systems for smooth data flow

Variable tax withholdings

Handle complex tax scenarios with support for variable rates and custom rules

Custom reporting

Generate tailored reports to meet your compliance and accounting needs

Sync data from your HR System for timely and accurate tax withholdings

Eliminate costly errors by seamlessly integrating and syncing with your payroll systems. Our platform supports leading HR tools like Remote, Justworks, Gusto, and more, ensuring real-time accuracy for tax withholdings and reporting.

Seamless integrations

Connect with Remote, Justworks, Gusto, and other HR systems for smooth data flow

Variable tax withholdings

Handle complex tax scenarios with support for variable rates and custom rules

Custom reporting

Generate tailored reports to meet your compliance and accounting needs

Sync data from your HR System for timely and accurate tax withholdings

Eliminate costly errors by seamlessly integrating and syncing with your payroll systems. Our platform supports leading HR tools like Remote, Justworks, Gusto, and more, ensuring real-time accuracy for tax withholdings and reporting.

Seamless integrations

Connect with Remote, Justworks, Gusto, and other HR systems for smooth data flow

Variable tax withholdings

Handle complex tax scenarios with support for variable rates and custom rules

Custom reporting

Generate tailored reports to meet your compliance and accounting needs

Sync data from your HR System for timely and accurate tax withholdings

Eliminate costly errors by seamlessly integrating and syncing with your payroll systems. Our platform supports leading HR tools like Remote, Justworks, Gusto, and more, ensuring real-time accuracy for tax withholdings and reporting.

Seamless integrations

Connect with Remote, Justworks, Gusto, and other HR systems for smooth data flow

Variable tax withholdings

Handle complex tax scenarios with support for variable rates and custom rules

Custom reporting

Generate tailored reports to meet your compliance and accounting needs

Clarity, transparency, and ease of use for employees and contributors

Empower your team with the flexibility and tools they need to manage taxable events confidently.

Clear compensation dashboard

Provide a transparent, easy-to-understand view of token allocations, vesting schedules, and taxable events

Self-serve tax calculation tools

Enable employees and contributors to calculate their tax obligations effortlessly

Flexibility for taxable events

Give your team the control they need to plan and manage their finances

Clarity, transparency, and ease of use for employees and contributors

Empower your team with the flexibility and tools they need to manage taxable events confidently.

Clear compensation dashboard

Provide a transparent, easy-to-understand view of token allocations, vesting schedules, and taxable events

Self-serve tax calculation tools

Enable employees and contributors to calculate their tax obligations effortlessly

Flexibility for taxable events

Give your team the control they need to plan and manage their finances

Clarity, transparency, and ease of use for employees and contributors

Empower your team with the flexibility and tools they need to manage taxable events confidently.

Clear compensation dashboard

Provide a transparent, easy-to-understand view of token allocations, vesting schedules, and taxable events

Self-serve tax calculation tools

Enable employees and contributors to calculate their tax obligations effortlessly

Flexibility for taxable events

Give your team the control they need to plan and manage their finances

Clarity, transparency, and ease of use for employees and contributors

Empower your team with the flexibility and tools they need to manage taxable events confidently.

Clear compensation dashboard

Provide a transparent, easy-to-understand view of token allocations, vesting schedules, and taxable events

Self-serve tax calculation tools

Enable employees and contributors to calculate their tax obligations effortlessly

Flexibility for taxable events

Give your team the control they need to plan and manage their finances

Need to launch a token or track existing vesting schedules and token tables?

Need to launch a token or track existing vesting schedules and token tables?

Need to launch a token or track existing vesting schedules and token tables?

2024 © Vesting Labs Ltd. All rights reserved

2024 © Vesting Labs Ltd. All rights reserved